|

|

|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

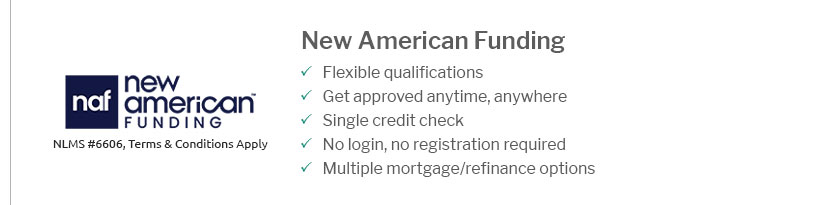

Exploring New American Funding Refinance Rates: A Comprehensive OverviewIn the ever-evolving landscape of financial services, staying well-informed about the latest refinance rates is crucial for homeowners seeking to optimize their mortgage terms. New American Funding, a prominent player in the mortgage industry, offers a range of refinancing options that cater to diverse financial needs. Understanding these rates can make a substantial difference in one's financial strategy, potentially leading to significant savings over the life of a loan. Refinancing with New American Funding can be a strategic move for many homeowners. Whether you're looking to lower your monthly payments, shorten your loan term, or tap into your home's equity, New American Funding provides competitive rates that might align with your financial goals. It's essential to consider various factors when evaluating refinance rates, such as the current market conditions, your credit score, and the equity you have built in your home. One of the key benefits of refinancing through New American Funding is the potential to secure a lower interest rate. A reduced rate can decrease your monthly mortgage payments, freeing up cash flow for other expenses or investments. Furthermore, refinancing can enable homeowners to switch from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage, providing stability in unpredictable economic climates. Additionally, New American Funding offers options for cash-out refinancing, which allows homeowners to access the equity in their homes. This can be particularly beneficial for funding home improvements, consolidating debt, or managing other significant expenses. However, it's important to weigh the costs and benefits carefully, as cash-out refinancing increases your mortgage balance.

However, it's crucial to approach refinancing with a comprehensive understanding of the associated costs. Closing costs, appraisal fees, and other expenses can add up, so it's essential to calculate the break-even point to ensure that refinancing makes financial sense in the long run. Homeowners should also remain aware of the potential impact on their credit scores, as refinancing involves a hard inquiry on your credit report. Ultimately, New American Funding's refinance rates present an array of opportunities for homeowners to enhance their financial standing. By carefully evaluating the options and consulting with financial advisors, homeowners can make informed decisions that align with their long-term objectives. Whether the goal is reducing monthly expenses, paying off the mortgage faster, or accessing home equity, refinancing remains a powerful tool in the arsenal of personal finance management. https://www.newamericanfunding.com/calculators/refinance-calculator/

*If rates change after you obtain a loan through New American Funding ("Lender"), you may qualify for a refinance loan ("refi") with Lender through the 5 ... https://www.newamericanfunding.com/mortgage-rates/30-year-mortgage-rates/

*If rates change after you obtain a loan through New American Funding ("Lender"), you may qualify for a refinance loan ("refi") with Lender through the 5-year ... https://www.newamericanfunding.com/refinance/

*If rates change after you obtain a loan through New American Funding ("Lender"), you may qualify for a refinance loan ("refi") with Lender through the 5 ...

|

|---|